The Suez Canal blockage has delayed vessel traffic to European ports during the week, while European bunker hubs continue to have readily available supplies of low sulphur fuels, according to Marine Bunker Exchange (MABUX).

Some East Mediterranean ports have seen stems delayed and cancelled, including Limassol in Cyprus. At the same time, suppliers were able to deliver VLSFO and LSMGO with 1-2 days’ notice in Piraeus, Malta and Istanbul.

In the meantime, South African ports, and especially Port Elizabeth, have had reduced availability of HSFO180 for months. Nearly half of South Africa’s refinery capacity has been offline since last year, when a fire and an explosion sidelined two refineries on different occasions.

South African suppliers have relied on imports of distillates and fuel oil to cover some of the domestic production shortfall, and the availability of higher-value VLSFO and LSMGO products has been better than for HSFO180. While Fujairah’s bunker market has mostly recovered from production issues two weeks ago, supply is now tighter as blending components have been held up in delayed tankers at the Suez Canal.

MABUX said there should be sufficient product stored in Singapore to meet a potential uptick in demand from eastbound vessels delayed by the Suez Canal blockage, but there has not been any noticeable increase in enquiries from these vessels yet.

At the same time, ongoing maintenance work at two local refineries has crimped resupply volumes to Far East Russian ports. Only one supplier has LSMGO available and limited volumes have pushed Russian prices for that kind of fuel up and above those in competing South Korean ports.

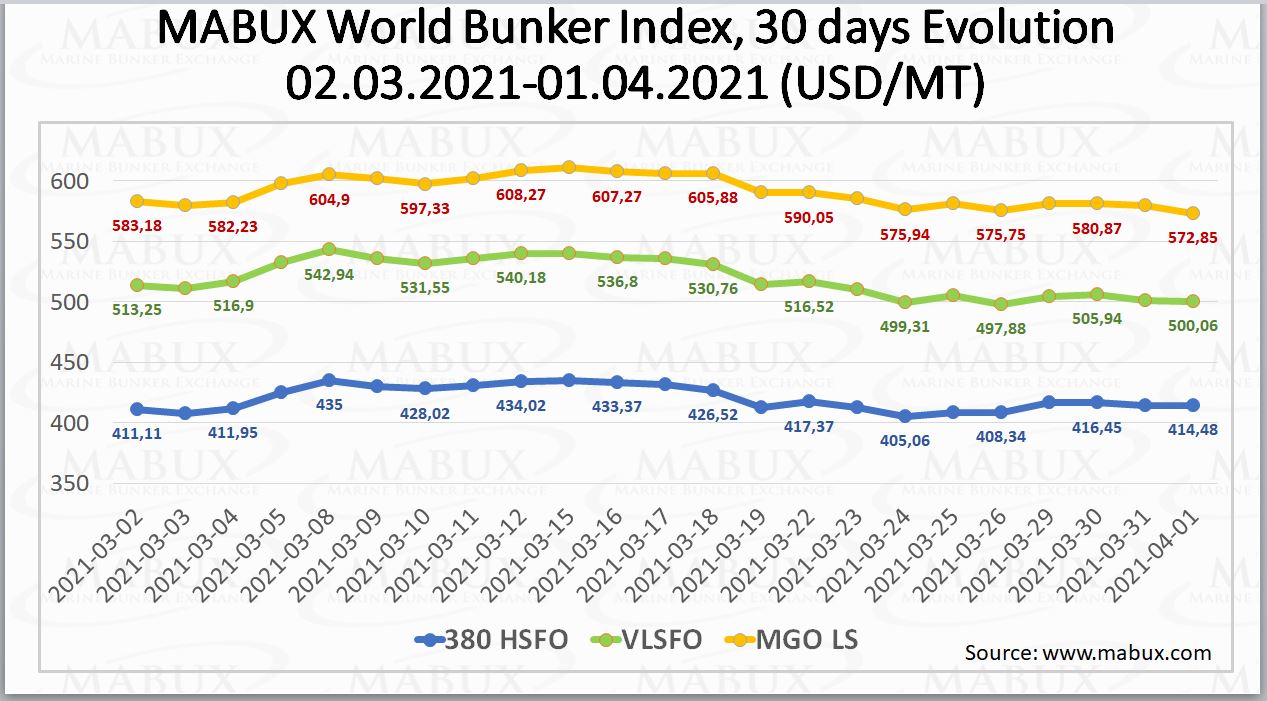

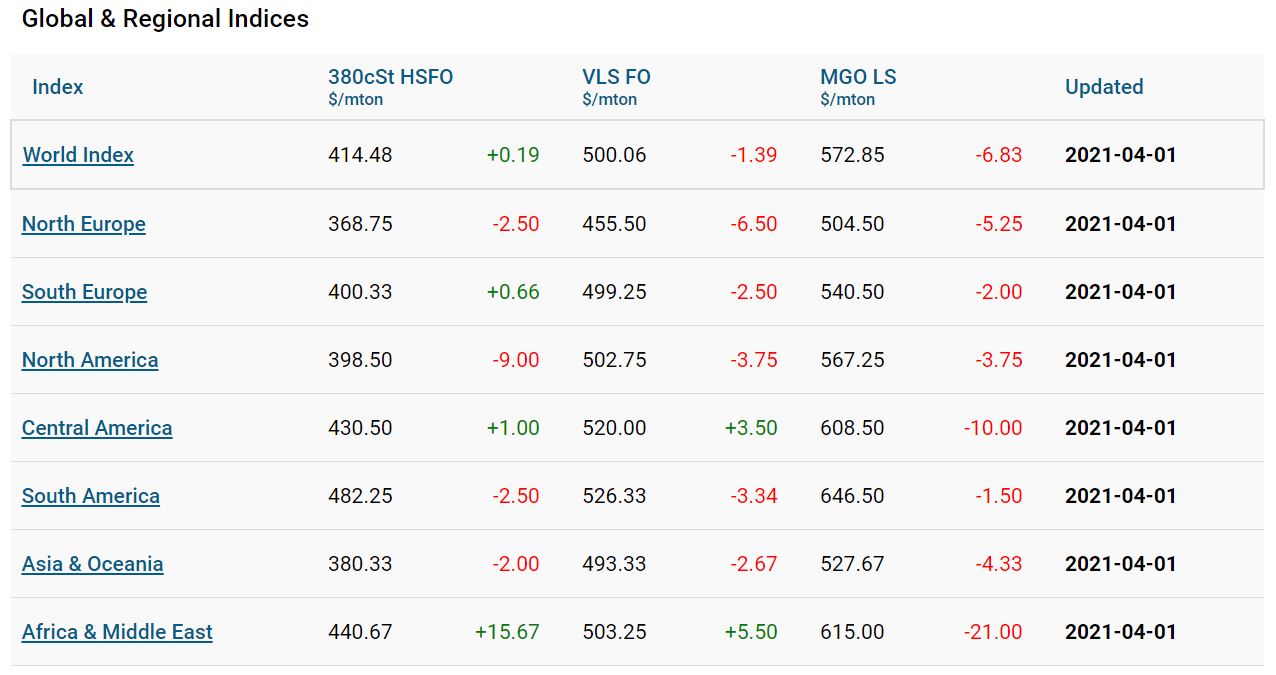

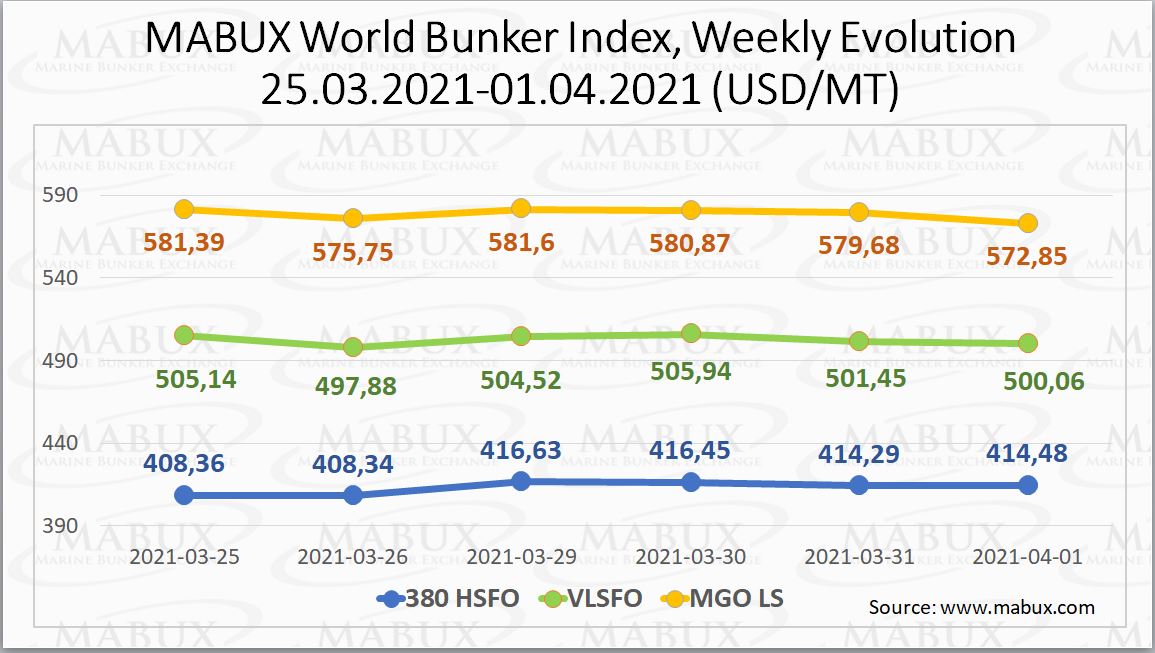

Meanwhile. MABUX World Bunker Index has shown irregular changes during the week with the 380 HSFO index increasing to US$414.48/mt, VLSFO has decreased to US$500.06/mt and MGO LS has fallen to US$572.85/mt.

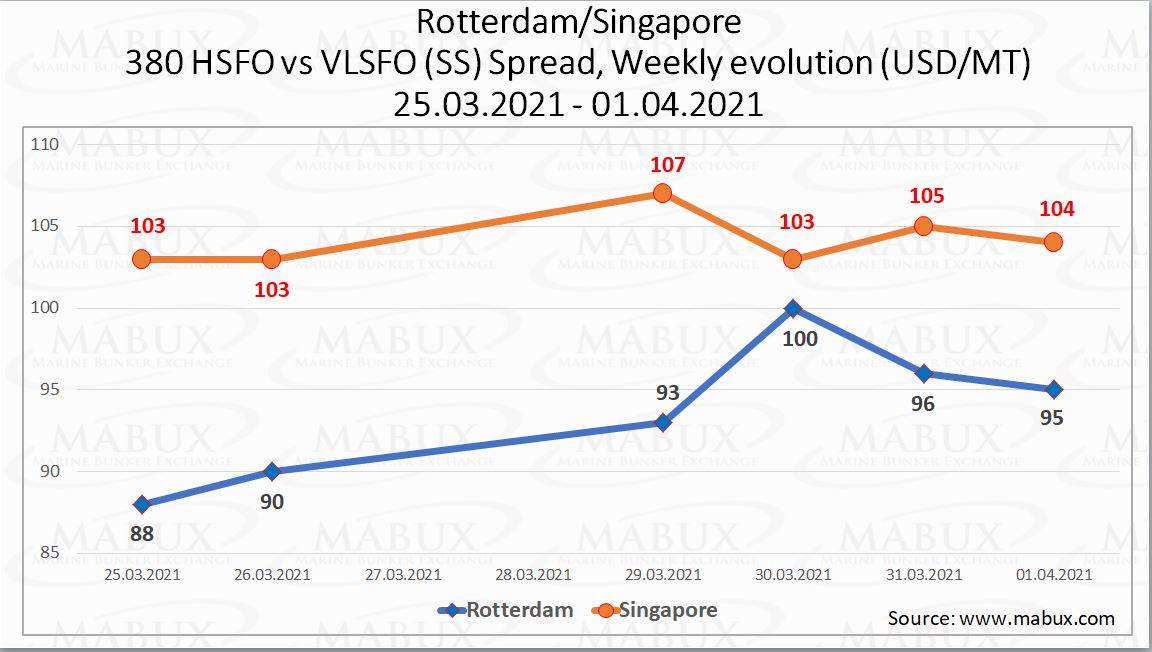

In addition, the Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – continued to decline during the week and averaged US$89.41.

The SS in Rotterdam increased during the week to US$95, the average SS for the week also increased last week to US$93.67. In Singapore, the SS has slightly increased during the week to US$104, while the average weekly SS index rose last week to US$104.17.

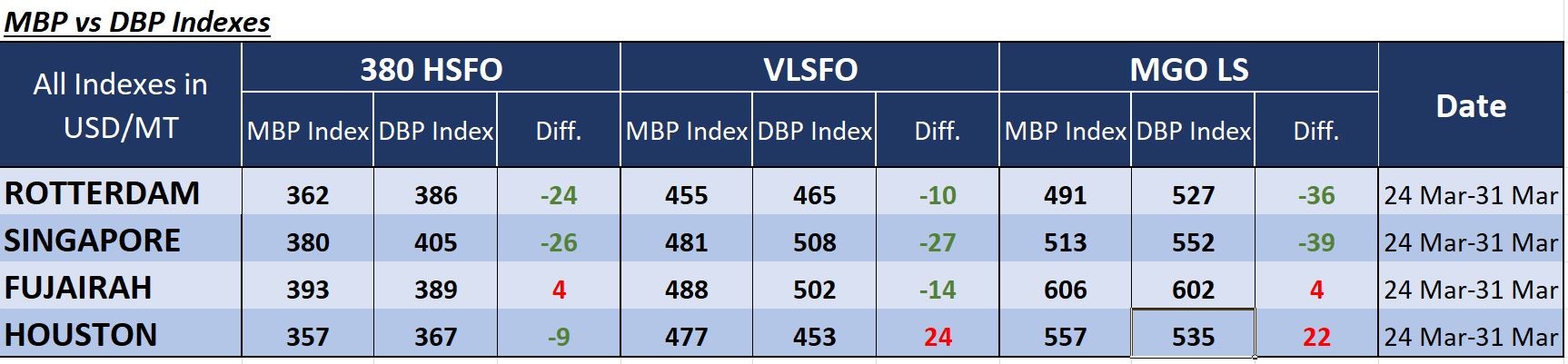

Furthermore, the correlation of MBP Index (Market Bunker Prices) vs DBP Index (MABUX Digital Benchmark) in the four largest global hubs during the past week showed that 380 HSFO remains undervalued in three selected ports in a range from US$9 in Houston to US$26 in Singapore, while it is overcharged in Fujairah by US$4.

Moreover, VLSFO, according to DBP Index, is undervalued in all selected ports in a range from US$10 in Rotterdam to US$27 in Singapore except of Houston, where it is overpriced by US$24.

Last but not least, MGO LS was also overvalued in Fujairah by US$4 and in Houston by US$22, while in Rotterdam and Singapore this type of fuel was underpriced by US$36 and US$39 respectively.

Hotline: 0944 284 082

Hotline: 0944 284 082

Email:

Email:

VN

VN