With the US election finalised and Biden now in office, VesselsValue’s AIS & Trade Manager Charlotte Cook – analyses trade data for the container sector and the impact that his appointment is expected to have on US Container demand.

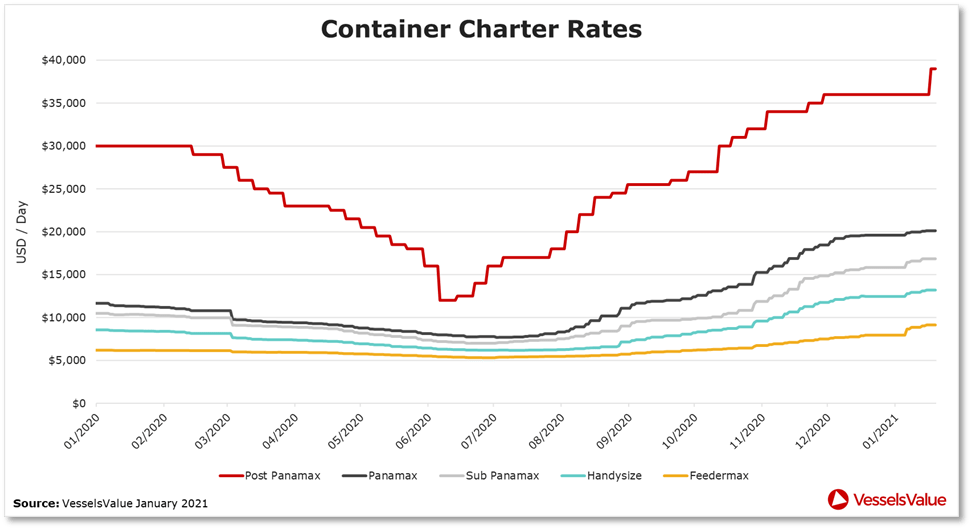

Biden’s win came at a time when container ship rates were, and continue to be, sky high with vessel demand surging globally after almost standstill operations in the first half of last year. After experiencing record high earnings in Q3 and Q4 of 2020 post-Covid, the container ship sector is expected to continue recovering as we move into 2021. Figure 1 below shows charter rates for the major types of container ships over the past year.

The best performing Containership types have been the larger sizes, listed in descending size order from left to right on Figure 1 above. For example, rates for Post-Panamax type container ships reached US$36k at the start of January 2021, 20% higher than the same period last year. It is also evident that January 2021 rates for sub-Panamax type container ships were up 50% compared to the same time last year. These strong market conditions for the larger container ship types have trickled down to the smaller handysize and feedermax types, which have seen rates increasing since the beginning of Q3 2020, but at a slower velocity than the larger vessels.

US Demand: Recovery

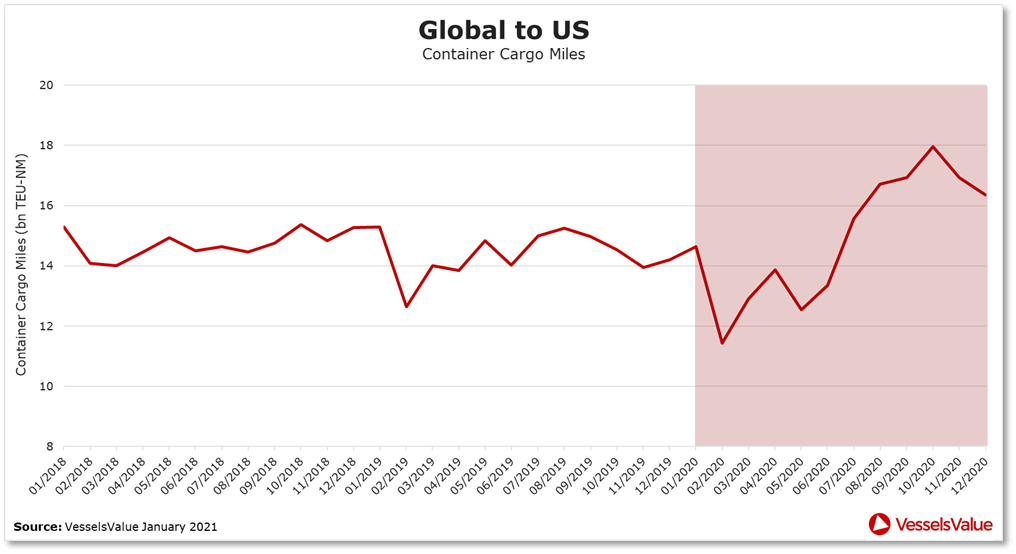

Alongside healthy rates across the sector, container ship cargo miles have been growing overall into the US since Q1 last year, reaching record highs. Cargo miles combine actual distances sailed by each vessel and estimates of cargo volumes (number of container ships) to indicate the true demand for vessels. Figure 2 shows cargo miles into the US since 2018 for all container ships between handysize containers up to largest ultra-large container vessels (ULCV).

Initially falling at the start of 2020 due to the onset of Covid-19, cargo miles quickly recovered after February 2020 as many Asian countries (especially China) contained the virus and re-started operations, alongside increasing demand in the US as lockdowns eased. A peak in cargo miles into the US was seen in October, reaching 17.9 billion TEU-NM, which was 23% higher than levels seen in 2019. Since then, cargo miles dropped marginally in November and December, but remained high.

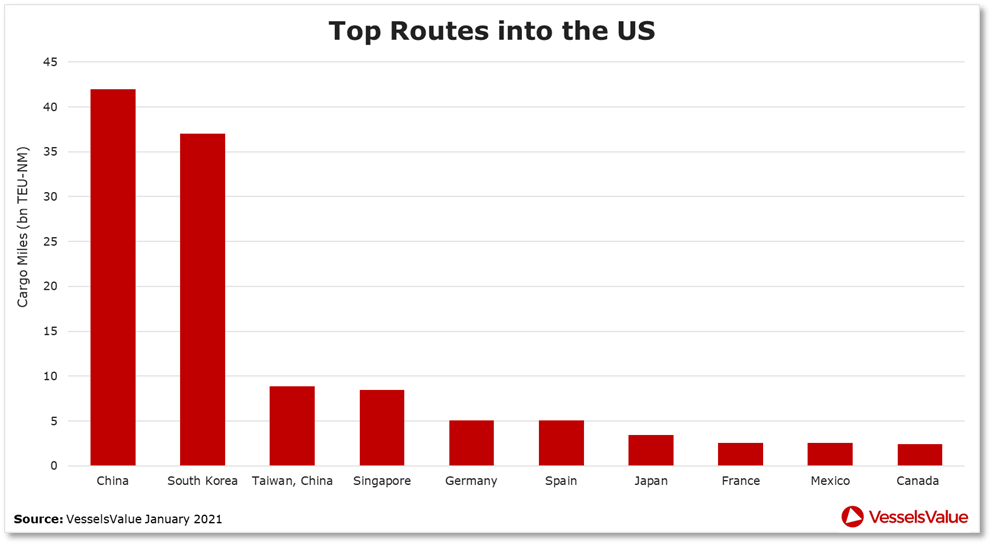

To fully understand this recovery, we must investigate where US imports are originating. Figure 3 shows the top 10 origin countries of imports into the US by container ships in 2020 (excluding intra-US trades).

As the chart shows, over the past year exports from China have been the primary driver of container ship demand into the US, followed closely by exports from South Korea. It is expected that Biden’s less protectionist approach to China will continue to support this underlying trade flow (rather than potentially hinder it through tariffs). Any signs Biden shows of improving Chinese relations bodes well for sustaining the current health of the container market.

Biden win: Good for US imports

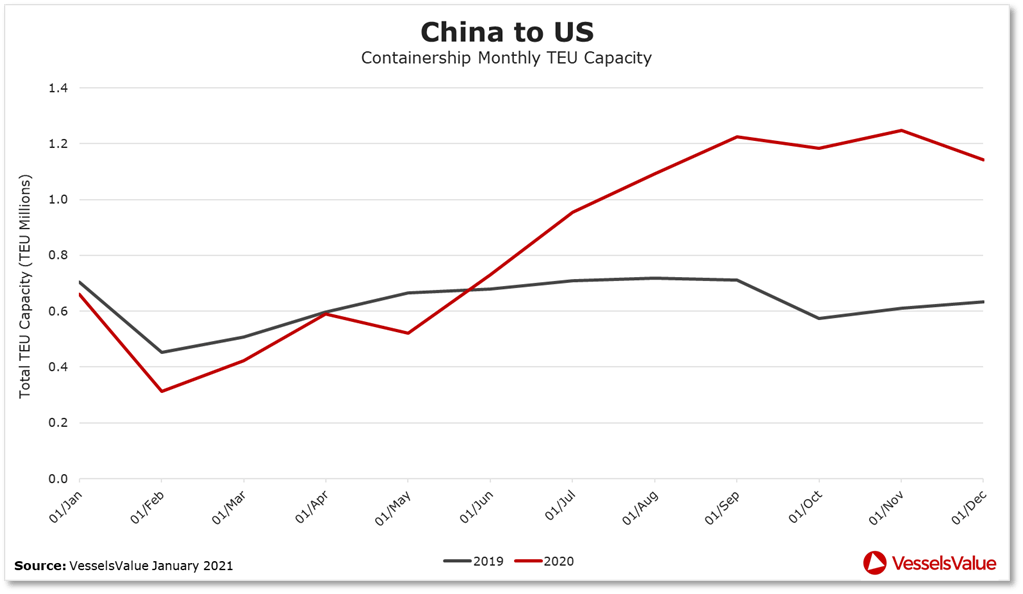

To further analyse the China to US trade flow, we will look at total capacity on the route since the beginning of 2019. Figure 4 shows a year-on-year view of total container ship (TEU) capacity for all container ships between handysize containers up to the largest ULCV’s, from China into the US.

As the chart shows, growth in capacity surpassed 2019 levels back in June 2020, growing at an impressive rate up until September and then levelling off. In Trump’s final months, US reliance on China for Covid related medical equipment kept imports high, despite his imposed tariffs. This demand is expected to continue at least until widespread vaccinations happen, well into Biden’s first year.

So far, Biden is keeping his cards close to his chest with regard to lifting any tariffs. However, his political tone suggests a much more collaborative approach with trading allies, and he has pledged to undertake a detailed review of current agreements. This could result in a softening of trade deals with China which could result in an increase in container imports into the US, something that we saw weaken during Trump’s term overall.

Additionally, Biden’s promise to prioritise stimulus spending is also a positive sign for container demand. Encouraging spending and online consumerisation is not only likely to improve the US economy, but also have knock on effects to global trade flows as the US will continue to receive goods from China and the East.

Despite these positive signs, Biden’s inauguration still comes with some uncertainties. Biden’s policies also place emphasis on investing in domestic US manufacturing, similar to some of Trump’s notions. If the US were to ramp up production, this could result in a decrease in some of the containerised imports that the US currently rely on. However, considering Trump’s previous attempts to re-ignite US manufacturing, any major shifts would likely be a longer-term consideration and would be unlikely to impact US demand in the mid-term.

Conclusion

In summary, the Container market is doing well and Biden’s win is a promising sign for sustaining this success. Many of Trump’s policies leaned towards restricting container flows instead of growing them. Conversely, Biden’s policies are expected to favour improving relationships with trading partners and back US stimulus spending, especially important in the wake of Covid. With many countries now rolling out vaccination programmes, container demand is likely to continue rising as economies recover and lockdowns are eased, keeping important Transpacific volumes strong.

To continue monitoring the outlook of the container ship market, it is important to keep an eye on some of these major global trade flows and demand data on these routes.

Hotline: 0944 284 082

Hotline: 0944 284 082

Email:

Email:

VN

VN