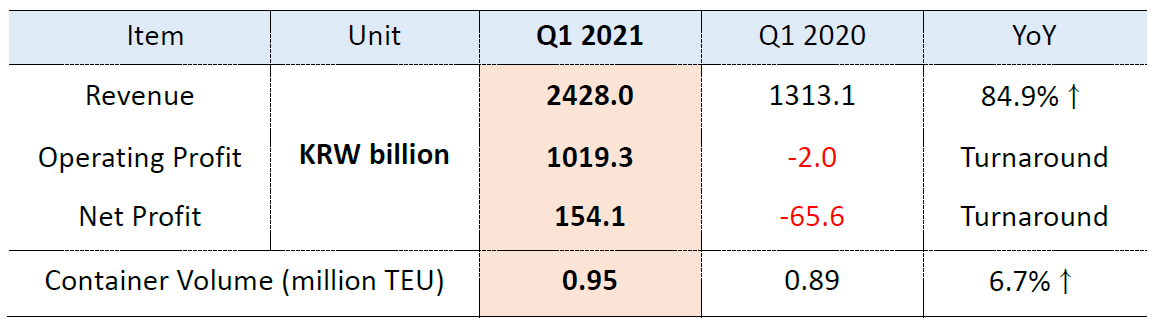

HMM has announced the highest operating profits in its history of US$900 million with a margin of 42%, while the South Korean container carrier has also marked an outstanding 85% revenue growth in the first quarter of 2021, reaching US$2.15 billion.

It is important to note that 2021 first-quarter earnings have already surpassed the earning for the whole of 2020 and this major increase is mainly driven by efficient fleet operations, according to HMM, including 12 new 24,000TEU vessels, higher freight rates and increased container handling volumes.

Particularly, box volumes have jumped into 950,000TEU in the first quarter, which represents a 6.7% increase compared with the same period last year. At the same time, the Q1 2021 net profit of the company was US$140 million, while in the first three months of 2020, HMM saw a US$58 million loss.

HMM believes the highly elevated freight rates will last through at least the first half of this year, while supply chain disruptions primarily caused by port congestion, the shortage of both vessel space and containers and increased cargo demand are not on course to be relieved over the short term.

The widespread Covid-19 and insufficient vaccination programme in many countries can lead to considerable uncertainty, negatively affecting container volumes on certain trade lanes, added HMM.

Since August last year, to handle an upsurge in cargo demand, HMM has deployed a total of 24 extra-loader vessels, consisting of 18 to the Asia-North America trade, 2 to the Asia North Europe trade, 3 to the Eastern Russia trade, and 1 to the Korea-Vietnam route. The South Korean line will continue to deal with market changes flexibly and will contribute to stabilising the logistics flow worldwide, according to its statement.

In addition, HMM will add 120,000TEU of dry containers in 2021 to alleviate the current shortage of container equipment. Around 42,000TEU have already been delivered and HMM plans to acquire the remainder until July.

Last but not least, HMM is taking delivery of eight 16,000TEU newly-built containerships, and five of them have been already deployed on the Asia-North Europe route. The company expects it will enable them to form an “enhanced cost structure and secure greater operational efficiency.”

Hotline: 0944 284 082

Hotline: 0944 284 082

Email:

Email:

VN

VN