In preparation for the 76th Marine Environment Protection Committee meeting to be held in June the International Maritime Organization (IMO) has released vessel fuel consumption figures collected for 2019.

Information reported to the IMO showed that 27,221 ships, of more than 5,000gt consumed 213 million tonnes of all the available marine fuels including LNG, and, unsurprisingly, the majority of this consumption was by containerships, bulk carriers and tankers.

Figures for 2020 will be eagerly awaited as the industry transitioned from HFO to VLSFO in the main from January of last year onwards.

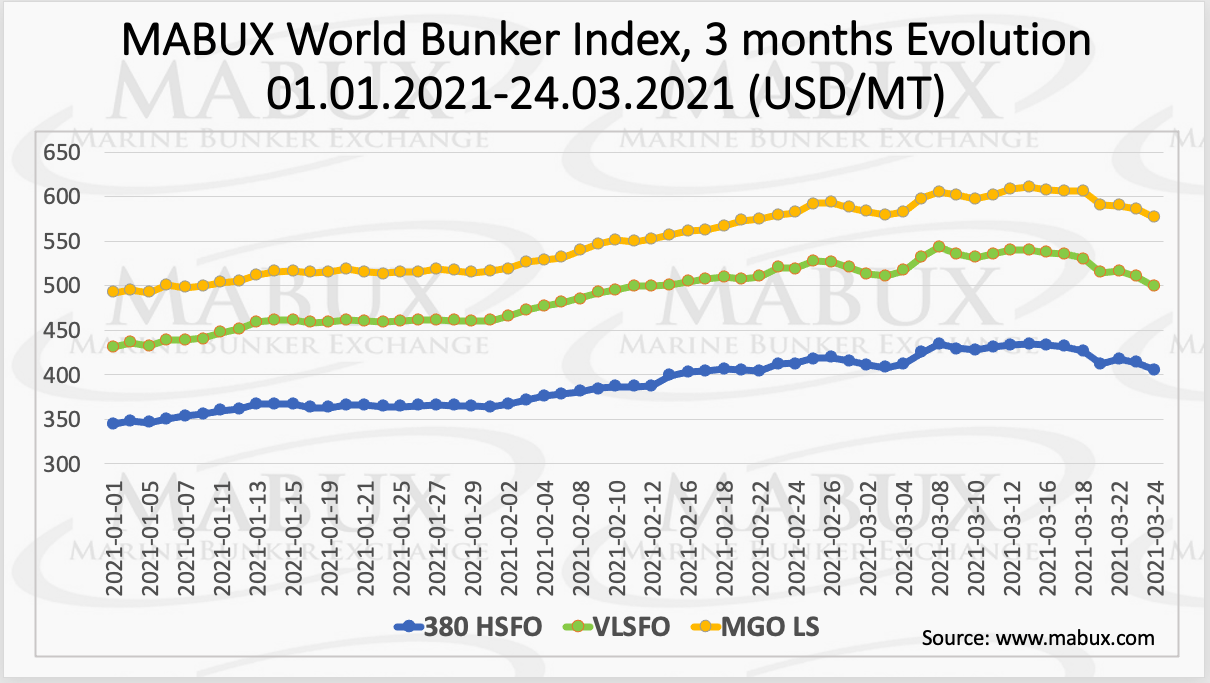

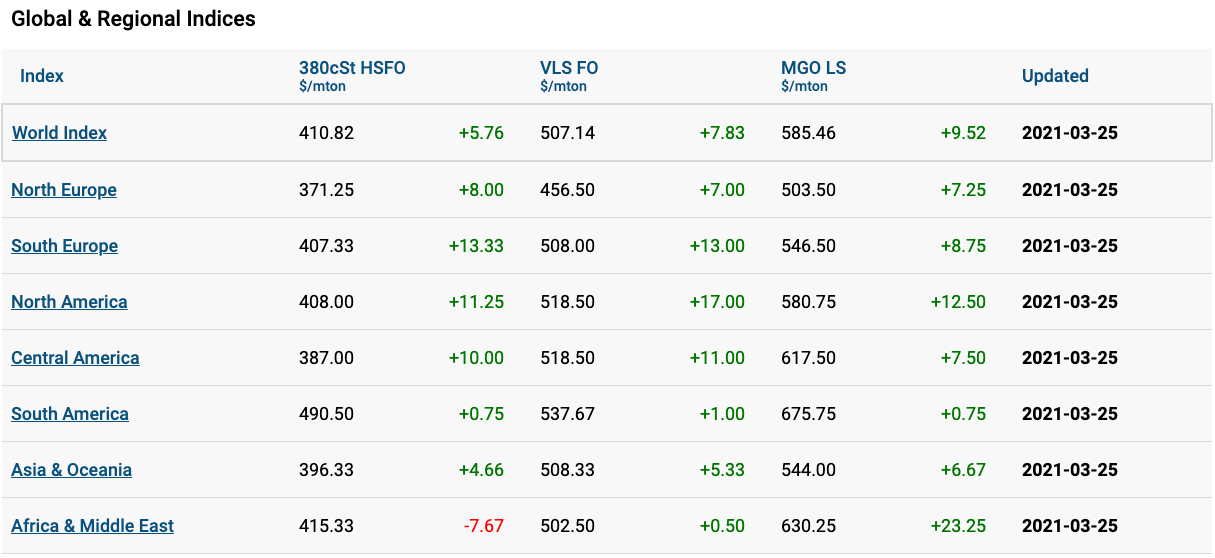

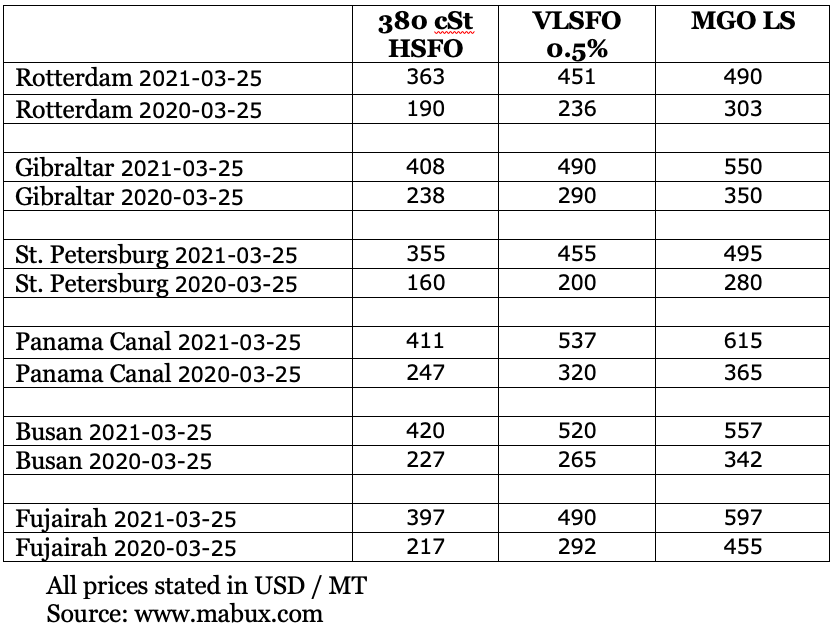

In the first quarter of this year, however, global bunker prices demonstrated firm upward shift according to the MABUX HSFO 380 Global Index, which averaged plus US$59.94/MT, MABUX VLSFO Global Index – plus US$67.80/MT and MABUX MGO Global Index – plus US$84.50/MT.

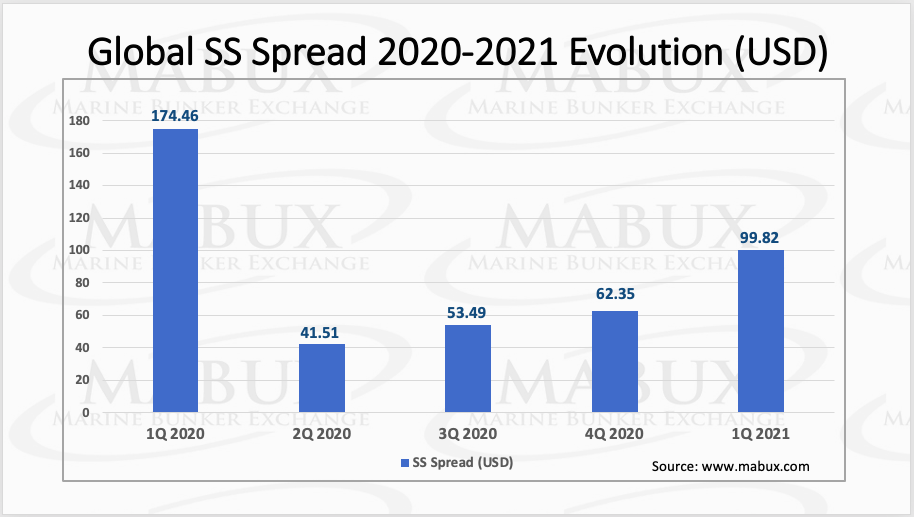

The Global MABUX scrubber spread (SS) (the difference in price between 380 HSFO and VLSFO) in Q1 2021 showed a steady recovery to the levels of the beginning of 2020 and averaged US$99.62 versus US$53.49 in Q3 2020 and US$62.35 in Q4 2020. The steady widening of the SS has brought back the relevance of scrubbers’ solution, especially in the segment of large-capacity vessels.

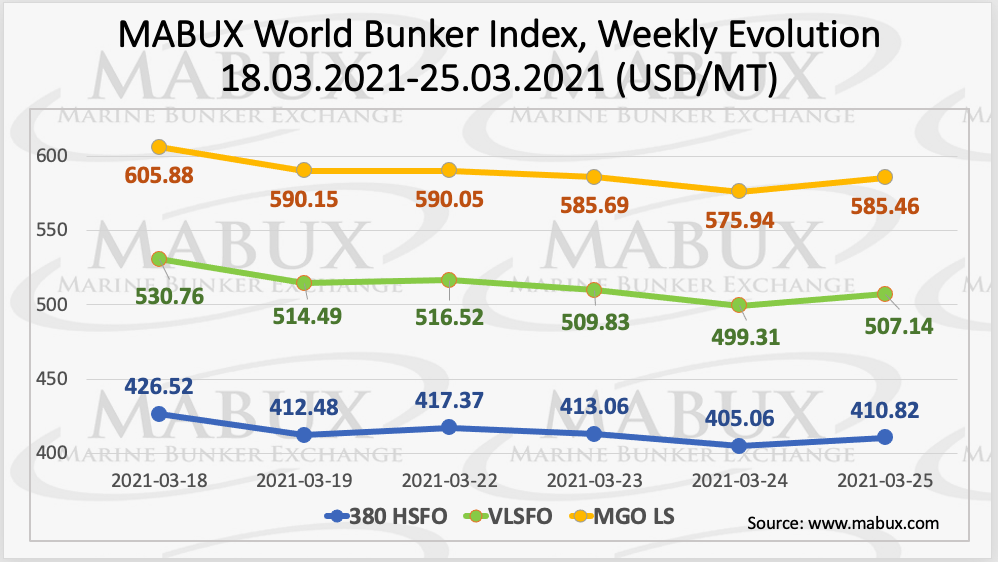

As for the week 12, MABUX World Bunker Index has turned into a firm downward movement, following the correction trend on the global oil market. 380 HSFO index fell by US$15.70, from US$426.52/MT to US$410.82 /MT.

The VLSFO Index decreased by US$23.62 from US$530.76/MT to US$507.14 /MT, while the MGO Index lost US$20.42 from US$605.88/MT to US$585.46/MT. The Global SS also showed a moderate decline and dropped below the US$100 mark again to US$98.79 versus US$104.27 last week.

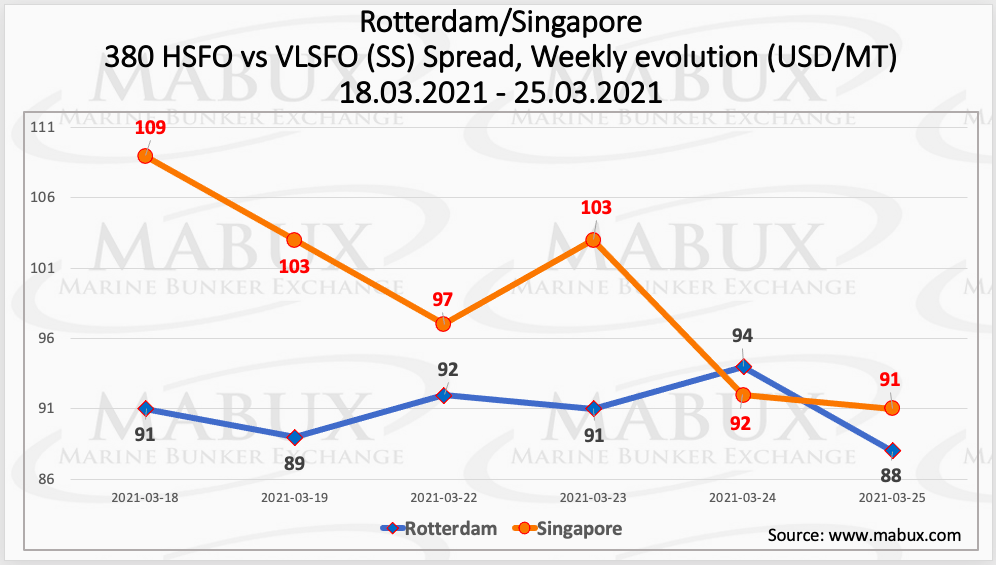

The SS spread in Rotterdam continued to narrow during the week, this time from US$91.00 to US$88.00, however, the average SS decreased more significantly: by US$8.50 from US$99.33 last week to US$90.83.

In Singapore, the SS index also showed a further reduction of price difference between 380 HSFO and VLSFO by US$18.00 from, US$109.00 to US$91.00, while the average SS index dropped by US$12.83: from US$112, 00 last week to US499.17. Despite the fact that SS index in the two biggest hubs is below the US$100 mark at the moment, this is most likely a temporary phenomenon linked to the correction on the global fuel market, and the SS still has growth potential.

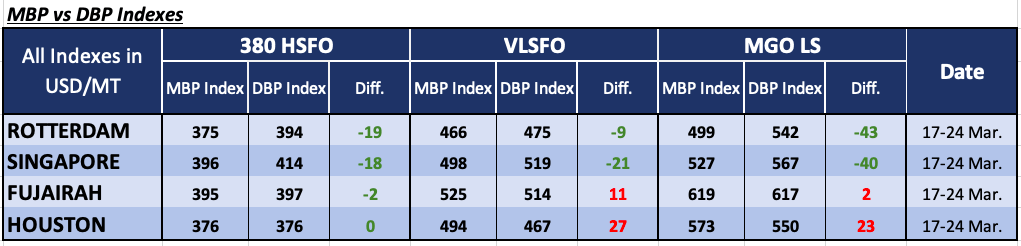

The correlation of Market Bunker Prices Index (MBP) vs MABUX Digital Benchmark Index (DBP) in the four global largest hubs during the past week showed that 380 HSFO fuel was under-сharged in three selected ports ranging from minus US$2 in Fujairah to minus US$19 in Rotterdam.

In Houston, there was a 100% correlation between the MBP and DBP Indexes. The DBP Index also registered an underpricing of VLSFO in two of the four selected ports. In Rotterdam the charge was minus US$9 and in Singapore it was minus US$21.

Fujairah and Houston recorded an average overcharging of VLSFO by US$11 and by US$27, respectively. MGO LS, according to DBP Index, was undervalued in Rotterdam by minus US$43 and Singapore by minus US$40. In Fujairah and Houston, this type of fuel was overpriced by US$4 and US$23, respectively.

Samples tested by Lloyd’s Register FOBAS in recent weeks in ARA have shown Total Sediment Potential (TSP) results exceeding the 0.1% m/m ISO 8217 specification limit. According to FOBAS, the TSP results ranged up to 0.35% m/m. The fuel testing agency highlighted that fuels with high sediments can result in excessive sludge deposition in tanks and throughout the handling and treatment/fuel injection systems.

Hotline: 0944 284 082

Hotline: 0944 284 082

Email:

Email:

VN

VN