Singapore-headquartered Ocean Network Express (ONE) experienced a notable decline in its revenues, earnings, and profits in the third quarter of fiscal year 2023 (October – December), in contrast to the corresponding period in the previous year.

The quarter witnessed a softening of the supply and demand trend, resulting from sluggish consumption growth, reduced cargo movement during the low season, and an influx of new ships.

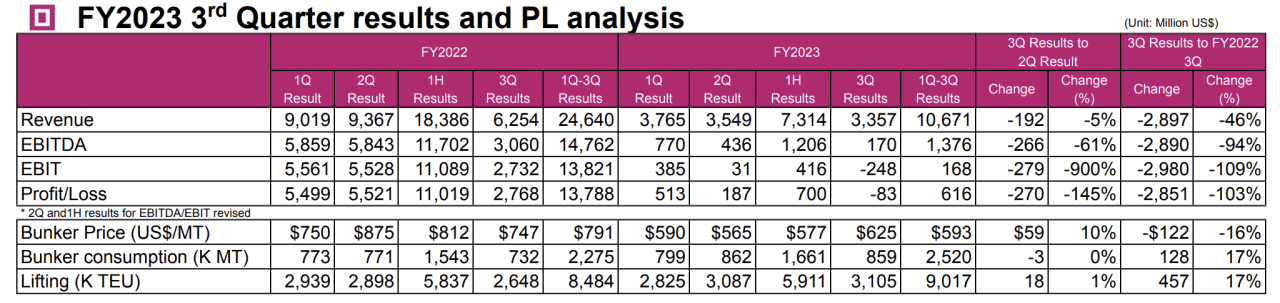

The company’s loss reached US$83 million, a striking contrast to the US$2.77 billion profit reported in 2022. Additionally, ONE recorded a 46% decline in the quarter revenues to US$3.3 billion. Moreover, the company’s Earnings before interest, taxes, depreciation, and amortization (EBITDA) also saw a reduction to US$170 million, down from the US$3 billion reported in FY2022 same quarter. Furthermore, earnings before interest and taxes (EBIT) experienced a downturn, reaching minus US$248 million, compared to the US$2.73 billion recorded in 2022.

According to ONE’s statement, in North America, domestic consumption remained robust compared to the previous quarter, but marine cargo movements slowed down as the low season commenced. Meanwhile, in Europe, prolonged inflation led to a stagnation in personal consumption. Additionally, cargo movements faced challenges, exacerbated by uncertainties surrounding the situation in the Middle East, preventing a full-fledged recovery.

ONE noted that the increase in new ship deliveries continued to contribute to the oversupply issue, although its efforts, such as implementing blank sailings and streamlining services, were made to address this issue. While freight rates experienced an increase in December, the overall average remained low throughout the quarter due to sluggish rates in October and November.

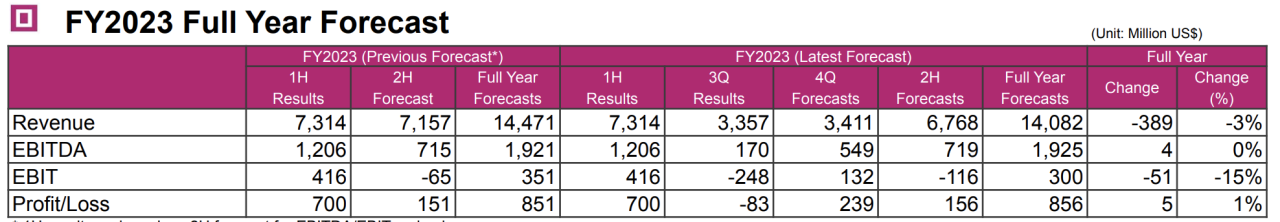

The anticipated full-year results for FY2023 indicate a projected profit after tax of US$856 million, marking a decrease from the previous year due to the adverse impact of the softening supply and demand in the freight market.

Despite a positive trend in cargo movements, the subdued consumer demand resulting from prolonged stagnation is hindering a robust recovery in cargo movements. The expectation is that a complete recovery in marine transport cargo movements will require additional time.

“The ongoing increase in supply, driven by the substantial number of new vessel deliveries, is set to persist. However, an immediate tonnage shortage has emerged due to the situation in the Middle East. While the outlook for supply and demand, as well as market conditions in the freight industry, remains highly uncertain, ONE will prioritize maximizing profit. This will be achieved through flexible tonnage deployment and efficient equipment control based on demand,” stated ONE’s spokesperson.

Sources: Container News

Hotline: 0944 284 082

Hotline: 0944 284 082

Email:

Email:

VN

VN