Port workers at Felixstowe are set to strike for eight days from Sunday 21 August until Monday 29 August, after rejecting the latest pay offer from port operator Hutchinson Ports. Felixstowe is one of the UK’s top container ports and a critical hub in the region’s logistics network. Any disruption will be a key risk factor in near term planning decisions of supply chain managers everywhere, from Wick to Woolacombe.

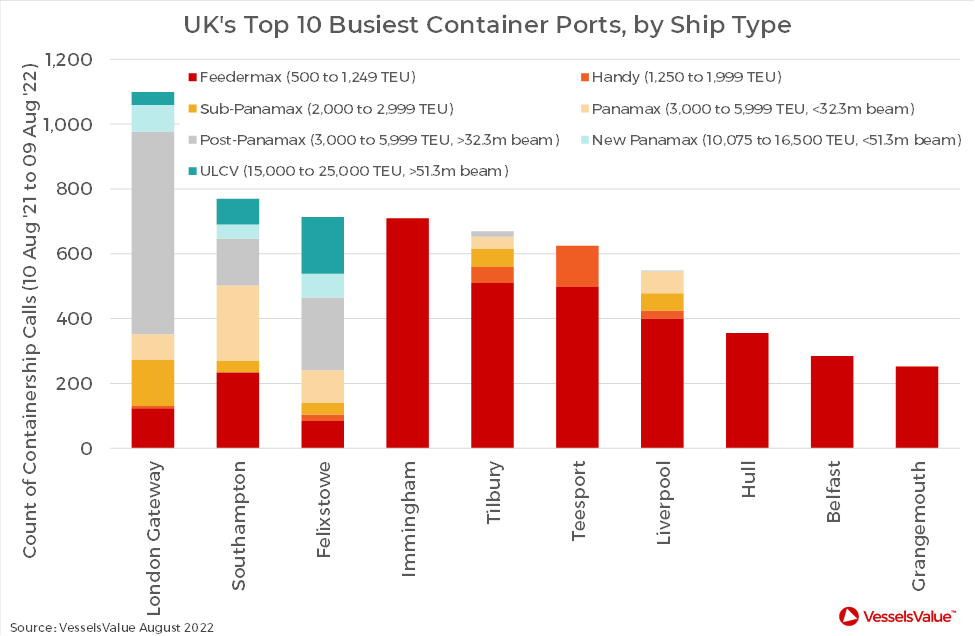

As shown in the following figure, Felixstowe has handled 713 container vessels in the last twelve months, behind only London Gateway and Southampton. However, it has berthed a greater proportion of the larger ship types than either of those two. This includes 175 of the very largest container ships, the Ultra Large Container Vessels (ULCVs), compared to Southampton’s 80 and London Gateway’s 40.

This also demonstrates that with twelve days forewarning before the strike is due to begin, alternatives exist for lines and shippers with any degree of flexibility. Following a recent spell of congestion at Felixstowe, major lines Maersk and Mediterranean Shipping Company (MSC) diverted their AE7 service, which originates in Shanghai and calls at Yantian and Columbo on the way (among others), to nearby Wilhelmshaven in Germany. However, depending on ship type, other UK ports may also be considered.

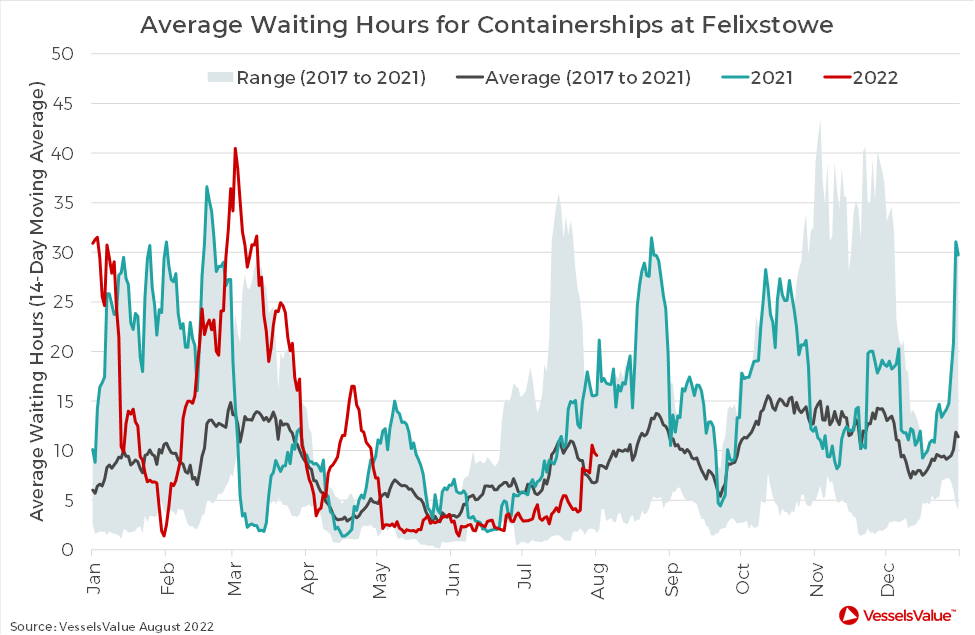

As shown in the figure below, from VesselsValue’s newly launched congestion module, when Maersk and MSC took this decision in October 2021, average waiting times for container ships at Felixstowe peaked at 28 hours, compared to a five year average of 15 hours for the time of year. Waiting times climbed as high as 40 hours earlier this year in March, but they have since reduced and are well within normal bounds. Waiting times are currently around 10 hours, compared to 21 hours this time last year and a five year average of 8 hours.

With average waiting times at three hours at Southampton, almost nothing at London Gateway, and six hours at Wilhelmshaven (which itself had a strike earlier this summer), logistics planners and supply chain managers will be keen to monitor how the situation at Felixstowe develops.

Author of the article: Vivek Srivastava, Senior Trade Flow Analyst at VesselsValue

Hotline: 0944 284 082

Hotline: 0944 284 082

Email:

Email:

VN

VN