Ever Given disrupted the trade bottleneck known as the Suez Canal, which handles around 12% of global trade annually, causing hundreds of vessels to stack up at either end of the waterway in less than a week and has led to US$900 million lawsuit.

The Suez Canal blockage prompts us to revisit access arrangements and practices for individual ships using capacity-constrained maritime infrastructures and passages. Such information is important for planning different operations and optimising infrastructure utilisation along the maritime supply chain.

On 23 March, 2021, the 20,124 TEU container ship Ever Given, one of the largest of the world, ran aground in the southern section of the Suez Canal. On 29 March it was re-floated. During the six-day blockage, more than 350 ships were waiting to transit the canal, and some other ships opted for the long detour around the Cape of Good Hope.

An analysis of how well the model of deriving queue numbers based on the arrival sequence of ships at the two entrances to the Suez Canal translates into actual passage through the canal. Based on observations, there is a method to predict queueing by forecasting the throughput of the Suez Canal based on “normal” patterns of arrival at the two ends. An elaboration on the concept of slot management for congested areas follows.

Competition for infrastructure

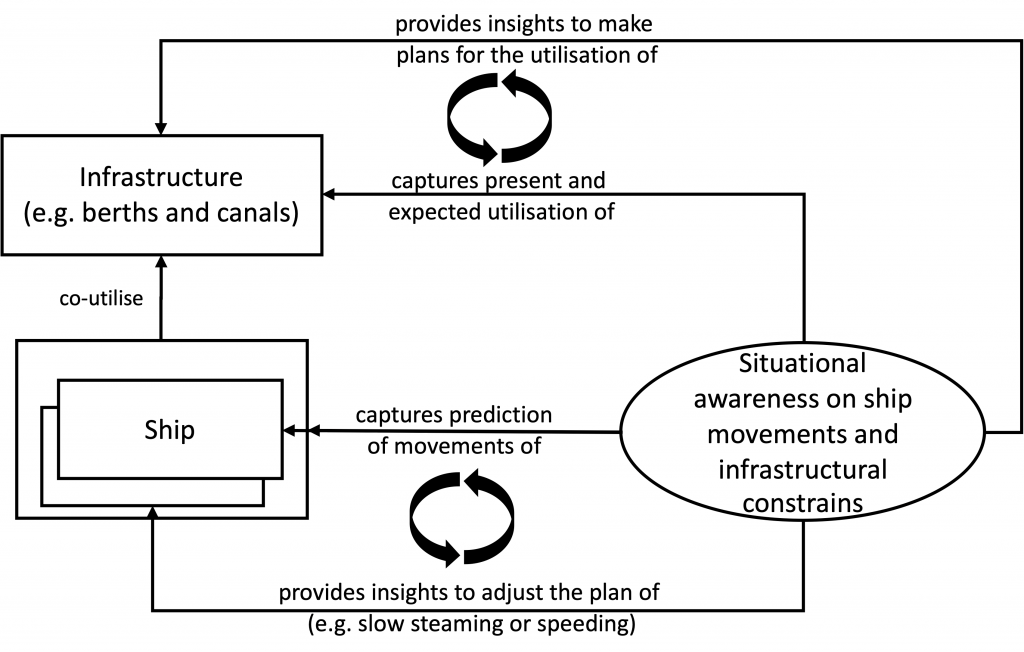

Shipping is probably the world’s largest and oldest sharing economy. Infrastructure, resources, and the natural environment are co-used by many actors requiring co-ordination for optimal operations. Digital data sharing could provide new levels of situational awareness and alignment for all the actors, helping to predict and coordinate the use of infrastructure and resources for more demand and need-driven operations.

The Suez Canal blockage provides an opportunity to understand better the self-organising nature of the maritime sector and to explore ways to improve coordination to reduce congestion and delays at shared infrastructure like canals and ports. During the Suez Canal blockage, northbound and southbound ship queues increased quickly. When the blockage was released, it took six days to reduce the queues to normal levels. Because of the need for one-way traffic in significant stretches of the Canal, even under normal conditions, ships need to wait to join a convoy.

Understanding the ship transits and how the flow and operation at capacity-constrained areas could be improved can be achieved by assigning a queue number to each of the ships arriving north and south of the Canal. Such a queue number can be derived from Automatic Identification System (AIS) data and the date and time a ship physically arrives at the Canal entrance. Expanded to data and predictions about ships heading towards the entrances of the canal, queue numbers might form a foundation for predicting and optimizing the time and timings for any ship to pass through the Canal.

Ship flows post-blockage

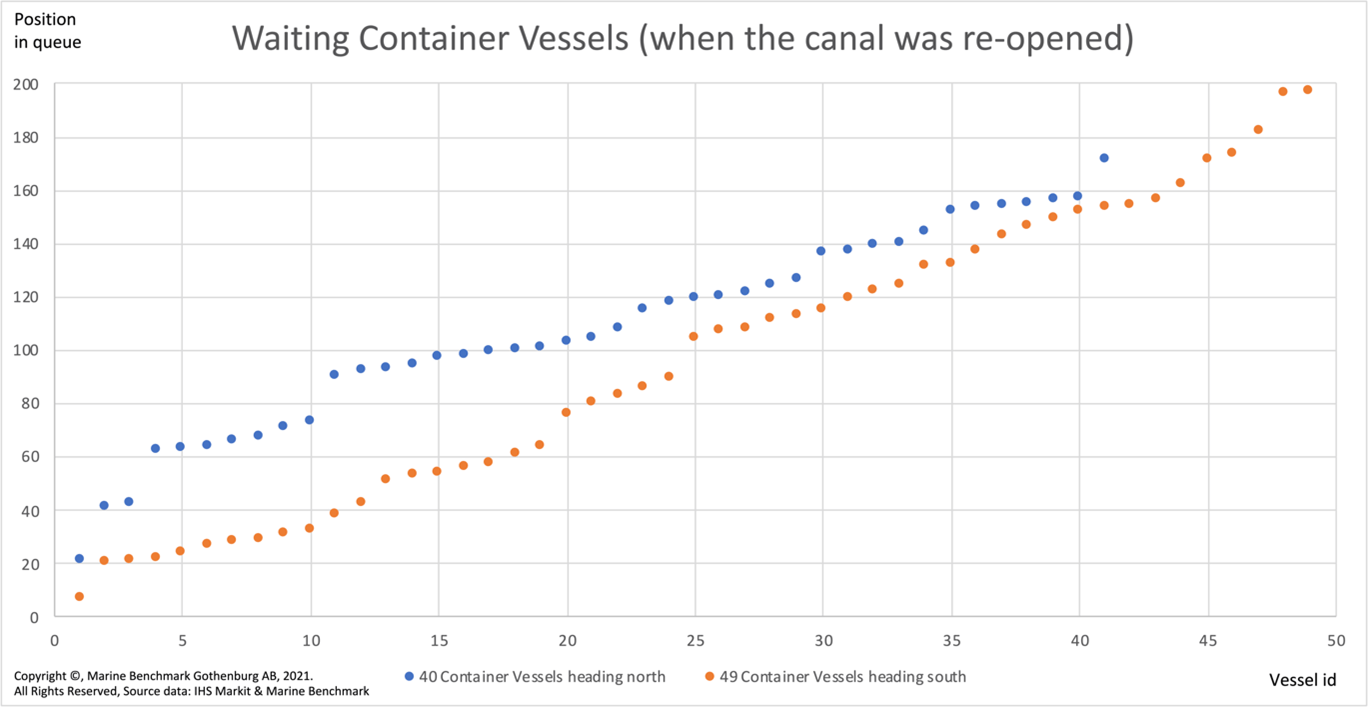

When the Canal was re-opened on 29 March 2021, there were more than 350 ships queuing at both ends. Out of these, there were 89 container ships waiting, including 40 northbound from the Gulf of Suez and 49 southbound from the Mediterranean Sea. Figure 1 shows the queue position of each of the identified container ships at the time when the Suez Canal was re-opened.

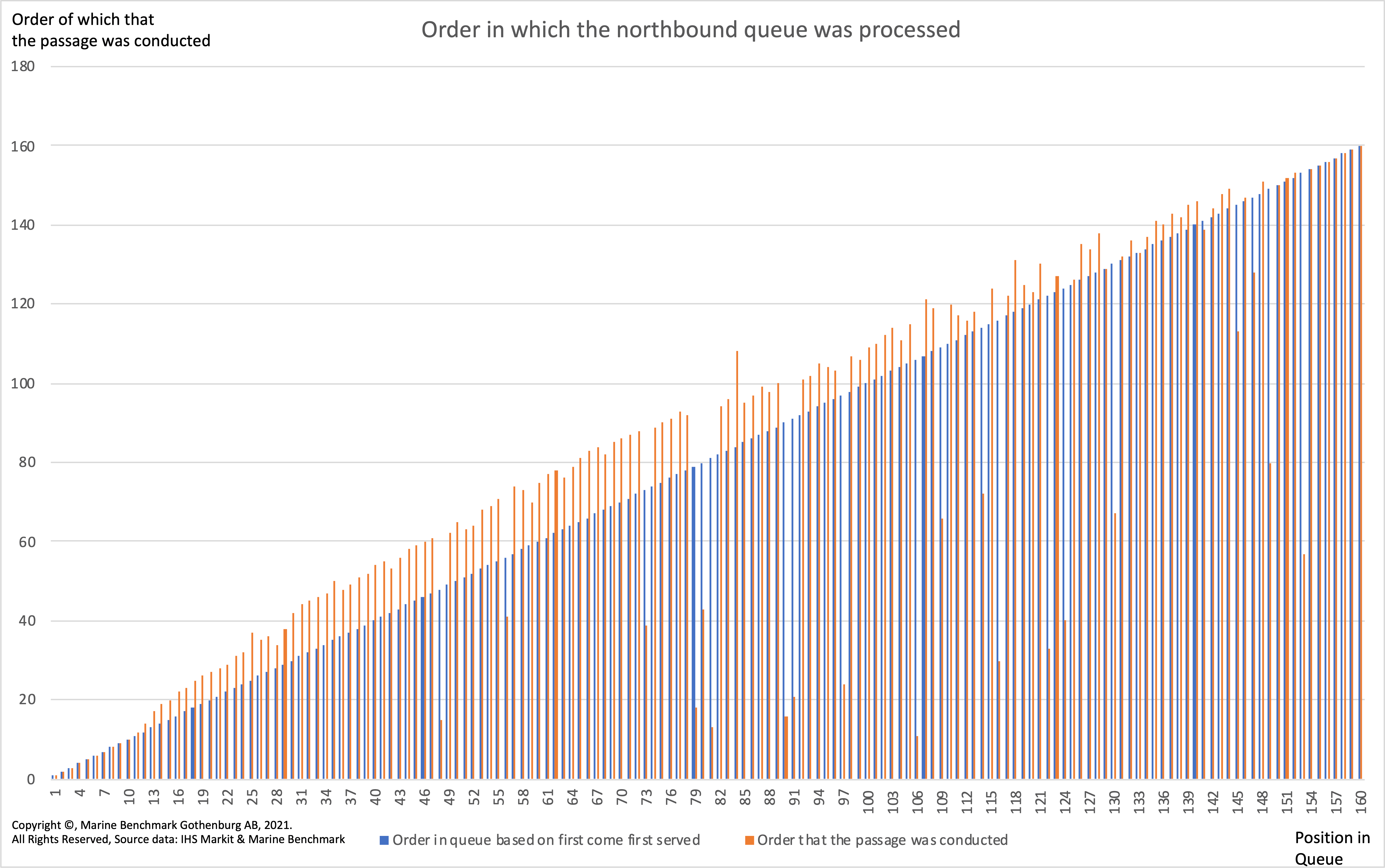

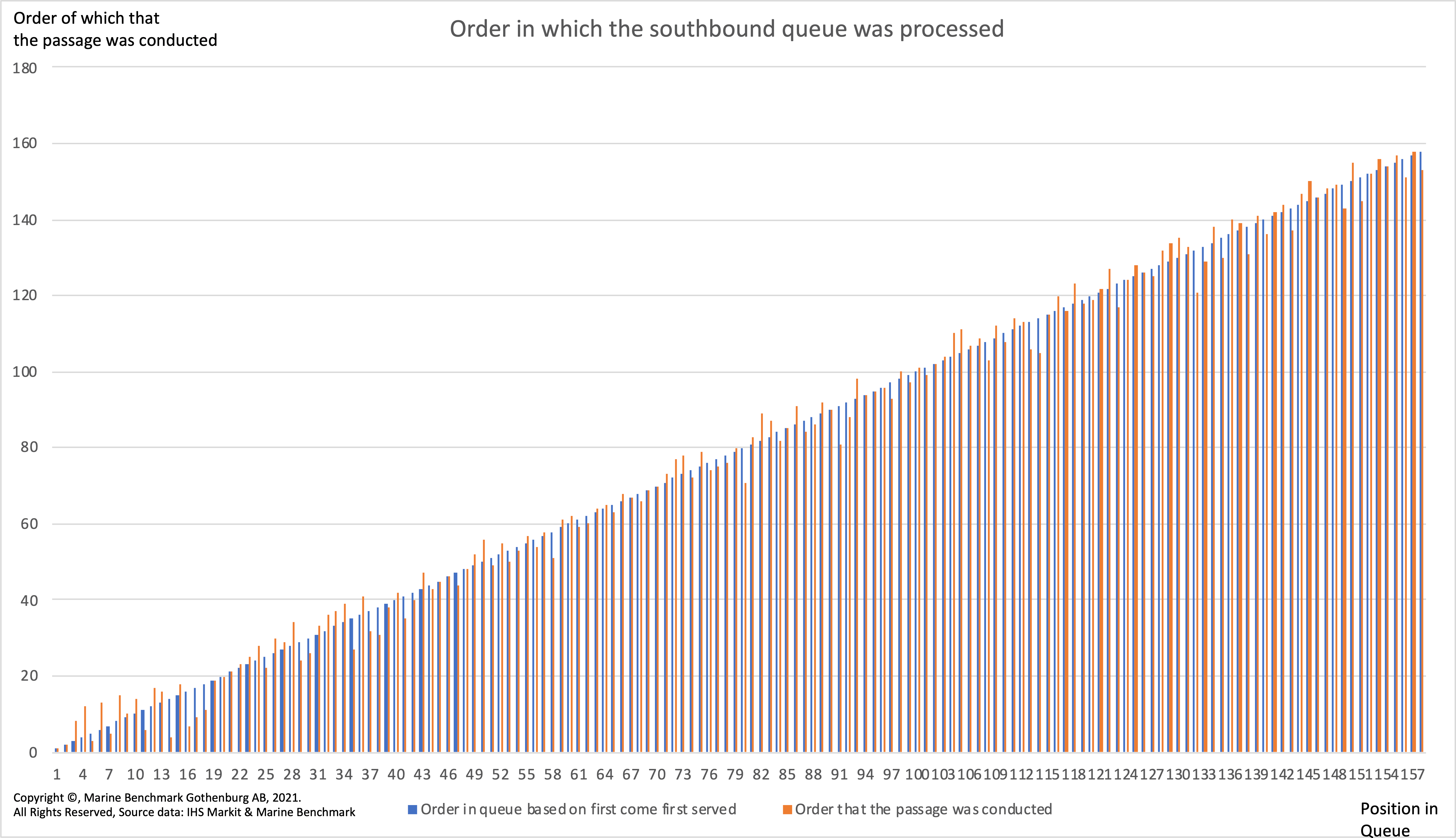

After six days the last ships in both queues had passed through the canal. Figures 2 and 3 show the container ships that transited northbound and southbound based on the number of hours they took to pass through (including waiting in line) counted from the canal’s re-opening.

The two diagrams above show that passage through the canal is governed primarily by a first-come, first-served principle. The small deviations between the assigned queue number and the actual order of passage are caused by ship convoy arrangements. For the most part, the container ships passed through the Canal in the order of their physical arrival.

Forecasting canal exit times

The day after the Canal re-opened, actors in the maritime supply chains could not estimate when a particular ship waiting in line would be able to pass through. The same concern was raised with respect to ships heading towards the waterway. This uncertainty highlighted the need for better tools for stakeholders to be aware of the actual situation and forecast the flow of ships through capacity-constrained chokepoints. Such visibility and forecasting tools would provide a much higher level of certainty as the basis for better planning.

Model description

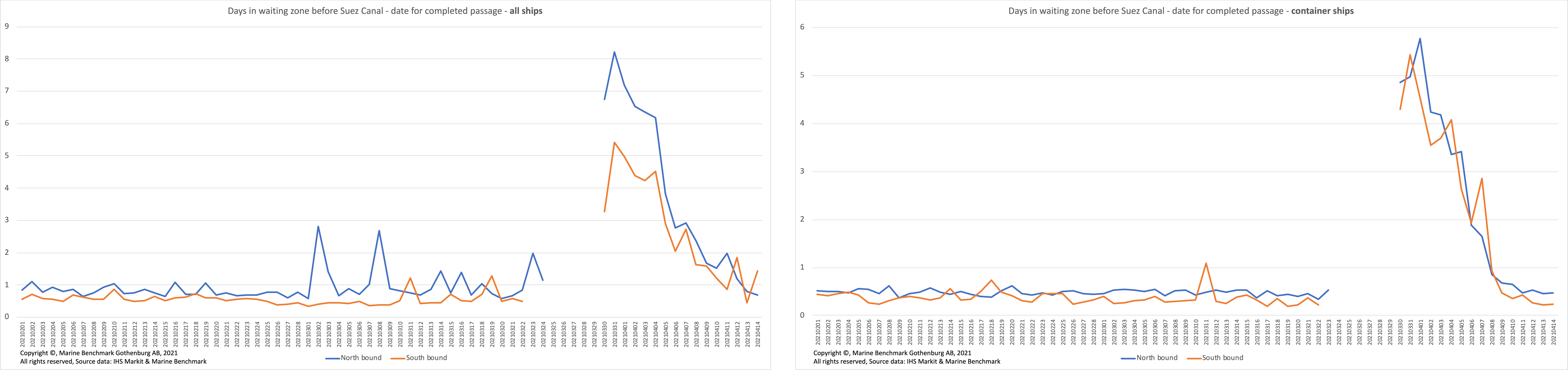

The AIS service, built upon Global Positioning System (GPS) tracking and using satellite communication technology, produces a real-life snapshot of the situation when the Suez Canal was re-opened. Such snapshots can be produced at any time and place. Figure 4 illustrates the waiting times for ships (north and south bound) between 1 February and 14 April 2021. The Suez blockage break is evident.

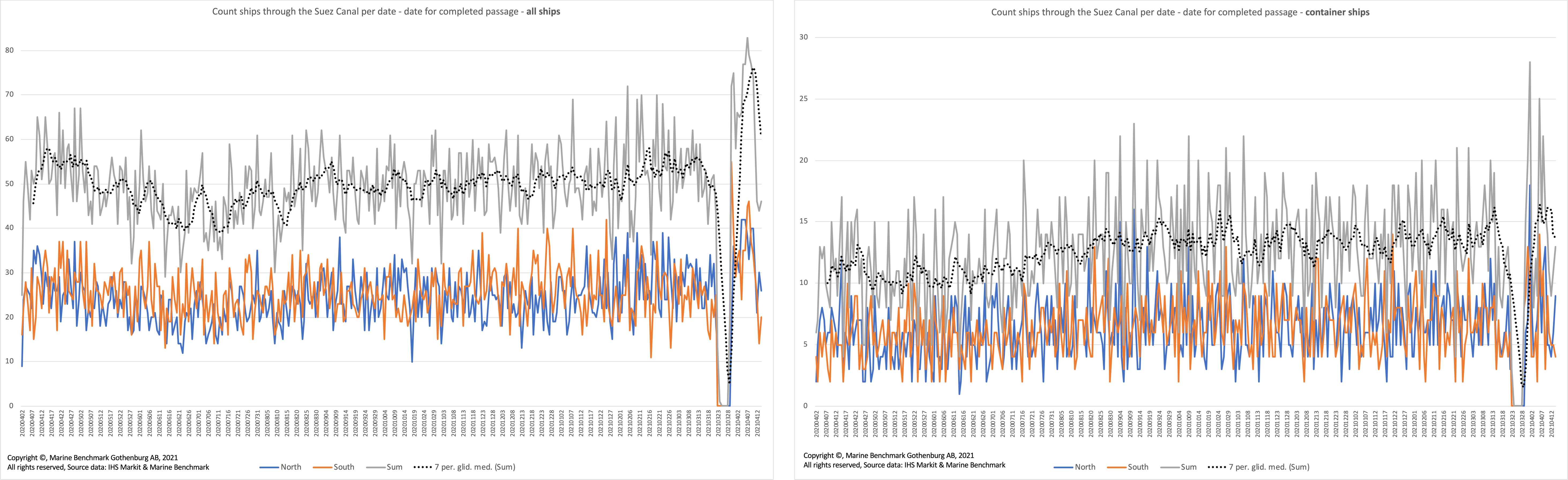

Figure 5 shows the number of ships passing through the canal from April 2020 to April 2021. The diagram shows an average throughput of around 50 ships every 24 hours.

Knowing or being able to estimate the transit capacity of the Suez Canal and the likely number of vessels waiting would enable the calculation of an optimal arrival time at an entrance and hence the optimal speed for a ship heading towards the canal. Combined with data on normal ship arrival patterns at the canal this could provide the basis for predicting when an approaching ship will be able to make a transit. This information and action upon it could lead to less queues and congestion and possibly to significant savings in fuel and emissions.

AIS data offers the possibility to capture the movement of all ships that are heading towards the canal. Thus, one can build prediction models that consider the number of ships heading towards the waterway to calculate expected waiting times and alternative slot availability. As ships adjust their speed, acting on such information and forecasts, the predicted future situation at the canal for other ships approaching would change. As such, each ship’s context becomes a function of the behaviour of other ships heading towards the canal. Continuous situational awareness updating in an open, data-sharing environment is therefore essential (as illustrated in Figure 6).

Figure 6 points to the need for a mechanism allowing both infrastructure providers and co-users to co-ordinate their operations virtually. Inspired by how human practices are arranged, it would be reasonable to consider implementing “virtual arrival and transit tickets”, awarded while the ship is en route. This would be the first step towards a demand and need-driven, slot-based model where the queue number is determined prior to ship arrival. This is a move from governing based on actual arrival to the virtual arrival and appointment economy now beginning to emerge in the maritime sector. However, this also means that those responsible for maintaining the infrastructure (such as canal authorities, port authorities, terminal operators), will need to support and integrate this new way of operating.

Similar moves have already taken place in the port sector with the introduction of vehicle booking systems (VBS) for managing the flow of trucks to collect and deliver containers, helping terminal operators optimise gate and yard operations and reduce truck queues outside their facilities. Transferring the virtual ticket concept to canal and port environments, regularly updated appointments between ships and terminal operators would also allow them to further optimise the VBS operation.

The effectiveness and viability of such models depend on broad participation in a forecasting and infrastructure management service, which must be easy to use and accessible to everyone. The higher the level of data intelligence on chokepoints and on shipping routes, the higher the accuracy level of the predictions that can be achieved as the basis for operations of ships and capacity-constrained infrastructure. Also, the longer the model runs, the more reference data are gathered helping to train the algorithms and deliver more precise predictions. Importantly, the combination of common situational awareness, and virtual queue tickets would provide better grounds for synchronizing sea transport activities.

Back to normal conditions

The Suez Canal blockage should make the global maritime and broader supply chain community reflect on the need to become more agile through a higher level of visibility on the situation at capacity-constrained chokepoints. That would enable improved predictability on arrivals and departures as well as canal passages. We suggest that such visibility needs to be combined with a concept of making appointments to optimise the utilisation of shared infrastructure. The first-come, first-served basis is the modus operandi applicable for many capacity-constrained zones, especially ports and canals. This leads to “hurry up, then wait” practices and consequently a wastage in fuel and unnecessary emissions. This should change in the interest of the industry, its customers and the environment, with due consideration to contractual provisions.

There might even be possibilities to establish processes and services to “jump the queue” if agreements are established for passage slots to be exchanged between different parties planning to utilise a canal or other chokepoints. The same holds true for destination ports. This would then form the foundation for enabling the shipping industry to inform subsequent actors in the value chain about arrival times.

Ports and terminals would be better able to plan cargo handling times and inform transport coordinators, trucking companies, barge and railway operators as well as importers and cargo owners. This would represent a major step towards the holistic approach outlined by Maritime Informatics. Ideally, the usage of such information would be coordinated amongst all shipping operators and terminal operators which would lead to a reduction in the risk of unanticipated port congestion as well as a more optimised berth allocation routine on the part of the terminals.

Transport ecosystem implications

The questions raised and challenges identified around fluid movements and congestion are valid for any chokepoint in the maritime system. Recent capacity challenges in the world’s major ports and hubs have triggered calls for more agile and resilient supply chains.

The easier solution may be brought about by data-driven models that help to deblock or even avoid such situations. Building intelligence around ship voyages and throughputs of maritime infrastructure will provide options to the different actors and empower them to make better economic and operational decisions.

Critical for success will be that the actors embrace such a model. Optimal system performance requires that we move towards a system of queue numbers and plan for infrastructure use in an elastic manner prior to ship arrival. A move towards a model built upon the appointment economy will allow for better synchronization. But that should be the next step. The initial effort should focus on creating a common in-depth understanding on how the maritime supply chain is managing and co-utilising infrastructure and resources.

The first-come, first-served principle may turn out to be an outdated model. Sharing data with trusted parties to build intelligence is an obvious goal in the digital age. Maritime digitalisation is accelerating and is an essential part of the solution. A maritime chokepoint deblocking methodology and model allowing for coordination prior to the physical arrival seems to us a timely and relevant call to action in today’s turbulent and uncertain times.

About the authors

Mikael Lind is the world’s first Professor of Maritime Informatics and is engaged at Chalmers, Sweden, and is also Senior Strategic Research Advisor at Research Institutes of Sweden (RISE). He serves as an expert for World Economic Forum, Europe’s Digital Transport Logistic Forum (DTLF), and UN/CEFACT. He is the co-editor of the first book of maritime informatics recently published by Springer.

Wolfgang Lehmacher is operating partner at Anchor Group. The former head of supply chain and transport industries at the World Economic Forum and President and CEO GeoPost Intercontinental is chairman of the board of directors of Logen, member of the board of directors of Roambee, advisory board member of The Logistics and Supply Chain Management Society, ambassador of The European Freight and Logistics Leaders’ Forum, and founding member of the think tanks Logistikweisen and NEXST.

Lars Jensen is a leading analyst in the container shipping sector, having worked 20 years in the field of predicting short and long-term trends, initially as Chief Analyst for Maersk and the past decade as an independent advisor and consultant in Vespucci Maritime (formerly known as SeaIntelligence Consulting).

Theo Notteboom is a maritime and port economist. He is Chair Professor at the Maritime Institute of Ghent University and Professor at Antwerp Maritime Academy and University of Antwerp. He also is Visiting Research Professor at Shanghai Maritime University. He is co-director of Porteconomics.eu, member of the Risk and Resilience Committee of International Association of Ports and Harbors (IAPH) and honorary president of the International Association of Maritime Economists (IAME).

Torbjörn Rydbergh is founder and Managing Director of Marine Benchmark and has a M. Sc in Naval Architecture from Chalmers and has been in the shipping and car industry for the last 25 years. He has worked for IHS Markit, Lloyd’s Register, and Volvo Cars among others.

Rachael White is Managing Director of Cool Logistics Resources, CEO of Next Level Information, Content Director at TOC Events Worldwide and a Member of Independent Port Consultants. She has spent the last 30 years in the maritime trade logistics world, designing, convening and chairing industry conferences, associations and communities and advising companies on industry trends

Dr. Hanane Becha, Senior Innovation and Standards Advisor, is the UN/CEFACT Vice Chair, Transport & Logistics and the Lead of the UN/CEFACT Cross Industry Supply Chain Track and Trace Project. She initiated and led the first Global Smart Container standards at the UN/CEFACT, and she is actively involved in many standards organisations including DCSA, SMDG, and IATA.

Luisa Rodriguez is Economic Affairs Officer at UNCTAD. She is a member of the team drafting UNCTAD’s annual review of maritime transport Within this team, her area of focus is mapping and analysing trends related to the supply of maritime transport services and infrastructure. She is also the editor of the UNCTAD Transport and Trade Facilitation Newsletter.

Peter Sand is BIMCO’s Chief Shipping Analyst. While spending 15 years in the global shipping industry, he constantly seeks to gain more insight, and make sense of it all. In turn, he shares his overview and outlook with the members of BIMCO specifically and the maritime sector in general.

Hotline: 0944 284 082

Hotline: 0944 284 082

Email:

Email:

VN

VN